To discover the most innovative names in Japanese menswear today, look beyond Tokyo and Paris to Florence. As the 109th Pitti Immagine Uomo trade fair begins this week in the Italian city, it features a packed schedule of runway shows and events from Japanese brands. Organizers are highlighting the growing influence of Japan’s tailoring-focused designers, who are using Pitti as a launchpad for global expansion.

With a weak yen making Japanese goods more affordable for international buyers, and a rising worldwide interest in Japanese fashion and culture, many brands from Japan are ready to go global—and Pitti offers the perfect platform. This timing has led to a new official partnership between the Japan Fashion Week Organization (JFWO) and Pitti, with plans for closer collaboration. “We’ve been working with Pitti since 2012, but since last January, we are now official partners,” says Kaoru Imajo, director of JFWO.

The connection between Pitti Uomo and Japanese designers goes back decades. Icons like Yohji Yamamoto (2005), Undercover by Jun Takahashi (2009 and 2018), and LVMH Prize 2024 winner Setchu by Satoshi Kuwata (2025) have all been part of Pitti in some way. This season, however, Japan’s presence is especially prominent.

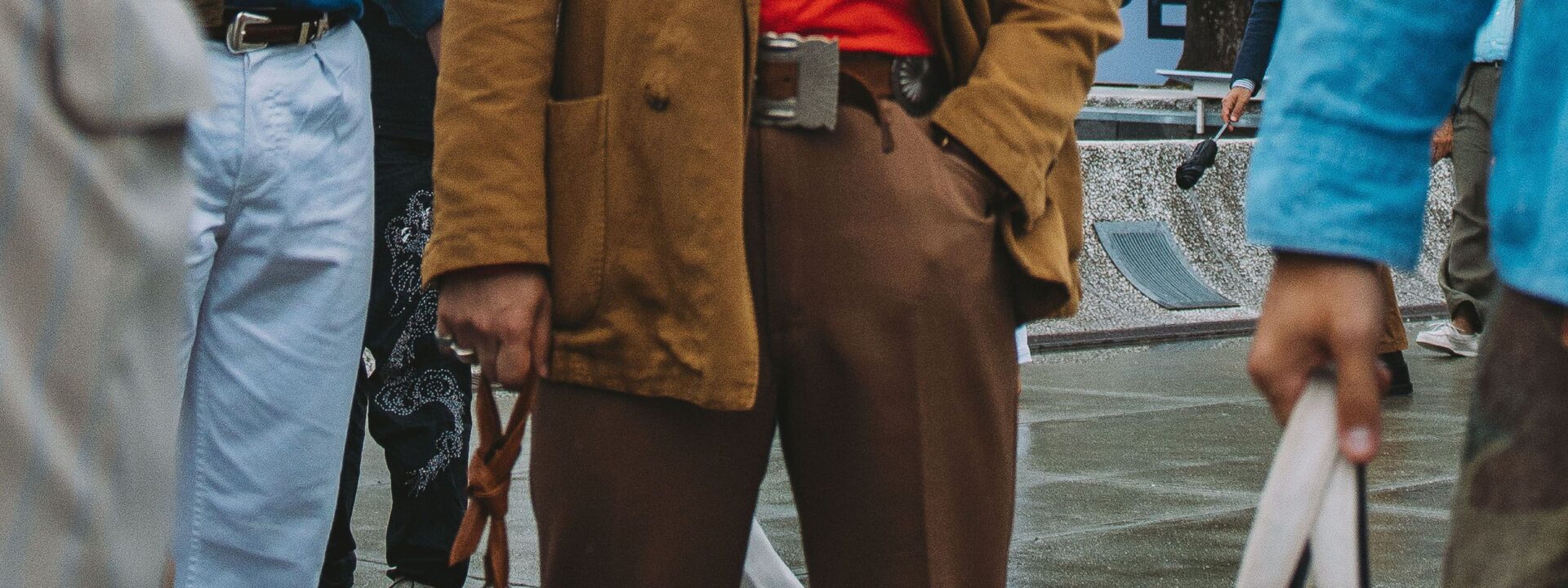

Yesterday, Japanese organizers brought the “Sebiro Sanpo” or “suit walk” event to Florence, sponsored by Italian fabric mill Vitale Barberis Canonico. Over 100 influencers and members of the public strolled through the piazzas in their finest tailoring—a Japanese twist on the classic “Pitti peacocking.” (Sebiro is the Japanese word for a business suit, believed to derive from “Savile Row.”)

Meanwhile, LVMH Prize winner Soshi Otsuki is Pitti’s special guest designer and will present his Armani-inspired tailoring on the runway on January 15—his first show outside Japan. Joining him is whimsical menswear designer Shinya Kozuka, known for his oversized silhouettes, who will also make his international runway debut as a “special feature” of Pitti, in partnership with Japan Fashion Week. (Paris-based Israeli designer Hed Mayner is also a guest designer this season.)

The week also includes the seventh edition of the J-Quality initiative, a showcase focused on Japanese clothing and production. It features a selection of Made-in-Japan manufacturers and the biotechnology firm Spiber, which creates a brewed protein used to make fabric.

“Every time we choose a designer, we look to Japan first,” says Francesca Tacconi, who oversees special projects for Pitti Uomo, including the guest designer shows. “I’ve been reading in every Italian magazine that the new tailoring is now Japanese. This is surprising because Italy is the hometown of tailoring, but there’s a new version with real attitude coming from Japan.”

As menswear moves beyond the streetwear boom, consumers are seeking fresh ways to dress. “[Japanese designers] bring a fresh perspective, proposing alternative ways of dressing that sit outside conventional menswear codes,” says Noelle Rodrigues, co-founder of the London store Future Present, which specializes in Japanese labels (and is currently Shinya Kozuka’s only UK stockist). She adds that the brands’ growing visibility reflects a consumer desire for menswear that isn’t confined by rigid categories like tailoring versus streetwear: “It suggests an interesting shift in how menswear is being understood and valued internationally.”This season, all eyes are on Otsuki. The brand is making a compelling new argument for the suit by merging the nostalgic feel of 1980s Italian tailoring with Japanese touches like karate-inspired shapes and kimono-style tie-jackets. “He reinterprets the suit, transforming ‘Made in Italy’ into his own ‘Made in Japan’ without simply copying Armani’s silhouettes,” says Tacconi. “This is the direction fashion needs to take; otherwise, it’s just about revisiting the past.”

Pitti is helping Japanese labels prepare for global growth. For Japanese brands and designers aiming to expand beyond their home market, Pitti Uomo is a vital next step. The timing is especially relevant for Soshi Otsuki, who had been conducting significant direct-to-consumer sales in the US until recent tariff changes. “We’ve currently paused shipments to the United States, so our situation there is on hold for now,” says Otsuki. He hopes the Pitti presentation will help secure more international stockists outside the US. The fair’s focus on menswear is also a key attraction. “A core mission of Soshiotsuki has always been to influence traditional menswear,” the designer notes. “In that sense, I don’t think there’s a more meaningful or relevant platform than Pitti to present my work.”

Shinyakozuka has similar ambitions. “Our commercial goal for the next few years is to build a solid organization and profit structure that allows us to sustain runway shows in Paris continuously, without excessive financial pressure,” says the brand’s director, Shimpei Kajiura. “Pitti is the first strategic step in establishing the brand’s image and credibility in international markets outside Japan.” With Shinyakozuka already generating half of its annual revenue internationally and experiencing year-on-year growth of 130% to 150%, the brand is well-positioned for a global push.

For many Japanese brands looking to grow their international stockist network and eventually show in Paris or Milan, the support and exposure offered by Pitti make it a sensible first step into Europe. The event often covers part or all of the show expenses for its guests. “Getting on the official Paris schedule isn’t easy, so Pitti is one of the faster ways for a brand to get there,” says Imajo. “People from the Federation de la Haute Couture et de la Mode [FHCM, which organizes Paris Fashion Week] come here to see what’s happening.”

Satoshi Kuwata of Setchu, who made his runway debut at Pitti Uomo last January, says the fair provided “great motivation” for his team. Although casting can be challenging—typically done in Milan before bringing models to Pitti—the platform proved invaluable. “Florence is a small city, so the exposure was impressive; we increased brand awareness almost overnight,” he says. Since the Pitti show, Setchu has consistently presented in Milan, where the brand is now based.

As for Kozuka, he plans to use Pitti as a learning experience with an eye toward eventually showing in Paris. “I’m very excited and curious to see how my sensibility, vision, and the scenes I try to depict are perceived here,” says the designer. “More than anything, I want to learn from that reaction.”

The smaller scale of the event also means more opportunity to stand out. For Otsuki, the moment to capture attention is now. “While I hope to present runway shows regularly in Paris or Milan in the long term, I don’t see this show as merely a step toward Paris,” says Otsuki. “I am approaching it with the mindset that this single show could change my life.”

Frequently Asked Questions

Of course Here is a list of FAQs about Pittis major investment in Japan designed to be clear concise and in a natural tone

General Beginner Questions

1 Who or what is Pitti

Pitti is a leading global company widely recognized in its industry This investment signals a major strategic move

2 What exactly is Pitti investing in in Japan

While specific details depend on the official announcement it typically involves opening flagship stores establishing a subsidiary partnering with Japanese distributors investing in local marketing or even acquiring a Japanese brand

3 Why is Pitti choosing to invest in Japan now

Japan is a key mature market with a sophisticated consumer base that values quality craftsmanship and brand heritageattributes that align well with premium brands Its a strategic move to capture market share and strengthen global presence

4 What does this mean for Japanese customers

Customers in Japan can expect better access to Pittis products potentially more exclusive collections improved customer service and a stronger brand presence through local events and marketing

5 Will this create jobs in Japan

Yes very likely A major investment usually involves hiring local staff for retail management marketing logistics and support roles

Advanced Strategic Questions

6 Is this a response to market trends in Asia

Partially While China often dominates headlines Japan represents a stable highvalue market This investment diversifies Pittis Asian portfolio and taps into consistent demand from discerning Japanese consumers

7 What are the biggest challenges Pitti might face in Japan

Key challenges include navigating complex local business customs fierce competition from both domestic and international brands high operational costs and adapting productsmarketing to nuanced Japanese tastes

8 Does this indicate a shift in Pittis global strategy

It signals a reinforced focus on direct market control in key regions Instead of relying solely on thirdparty distributors Pitti is likely investing to own its brand narrative and customer experience in Japan which is a more advanced market entry strategy

9 How might this affect Pittis existing partners or distributors in Japan

If Pitti is setting up its own subsidiary it may phase out or redefine relationships with existing importers